The Social Security System (SSS) in the Philippines is a government-run program that provides social insurance to Filipino workers.

The SSS contribution table for 2024 has been updated to reflect changes in contribution rates and salary credits.

This article will provide a comprehensive guide to the SSS contribution table for 2024, including how to calculate contributions, the benefits of contributing to the SSS, and the deadlines for payment.

Understanding the SSS Contribution Table for 2024

The SSS contribution table is a tool used to determine the amount of money that employees, employers, self-employed individuals, and voluntary members need to contribute to the SSS each month.

The contribution amount is based on the member’s monthly salary credit (MSC), which is a predetermined amount that represents the member’s monthly earnings.

Key Changes in the 2024 SSS Contribution Table

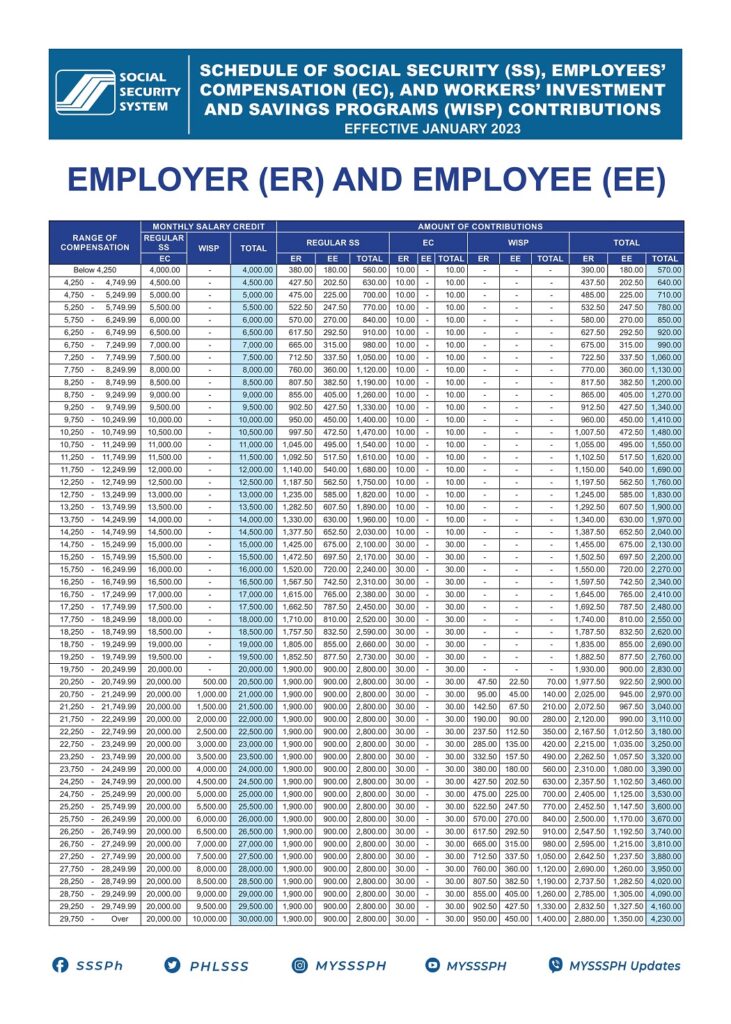

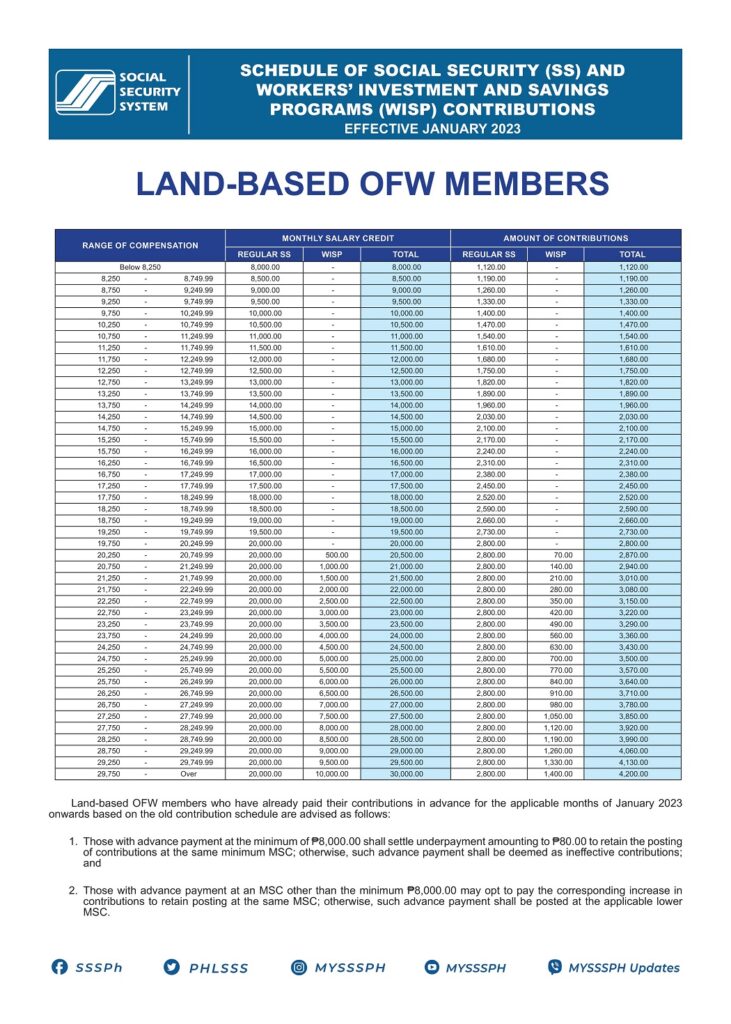

- Contribution Rate Increase: The SSS contribution rate has increased to 14% in 2024, up from 13% in previous years. This increase is part of a scheduled series of rate hikes mandated by the Social Security Act of 2018 (Republic Act No. 11199) .

- Monthly Salary Credit Adjustment: The minimum MSC is set at PHP 4,000, and the maximum MSC is PHP 30,000. This adjustment ensures that contributions are aligned with the current economic conditions and salary levels .

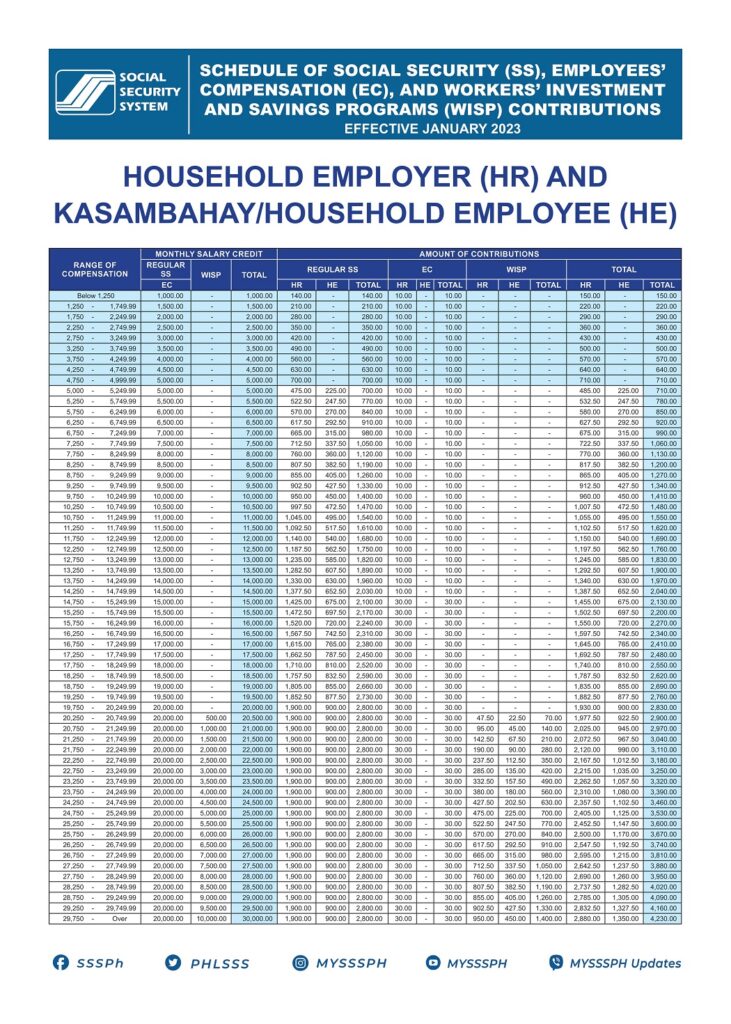

- Employer and Employee Share: For employed members, the contribution is split between the employer and the employee. The employer’s share is 9.5%, while the employee’s share is 4.5% .

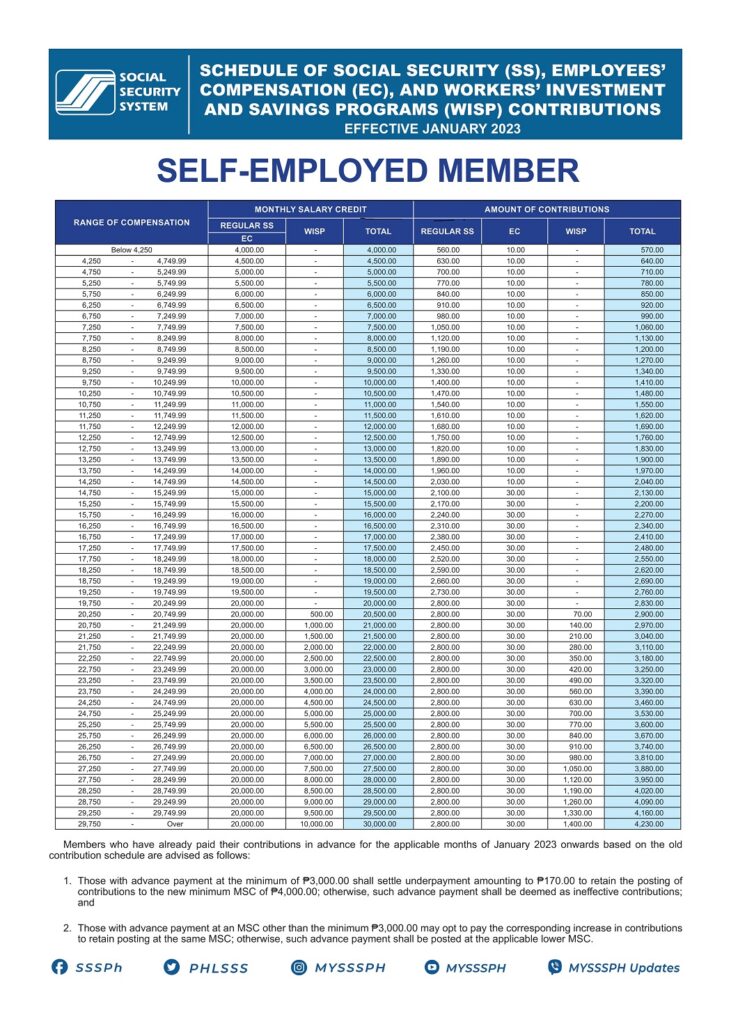

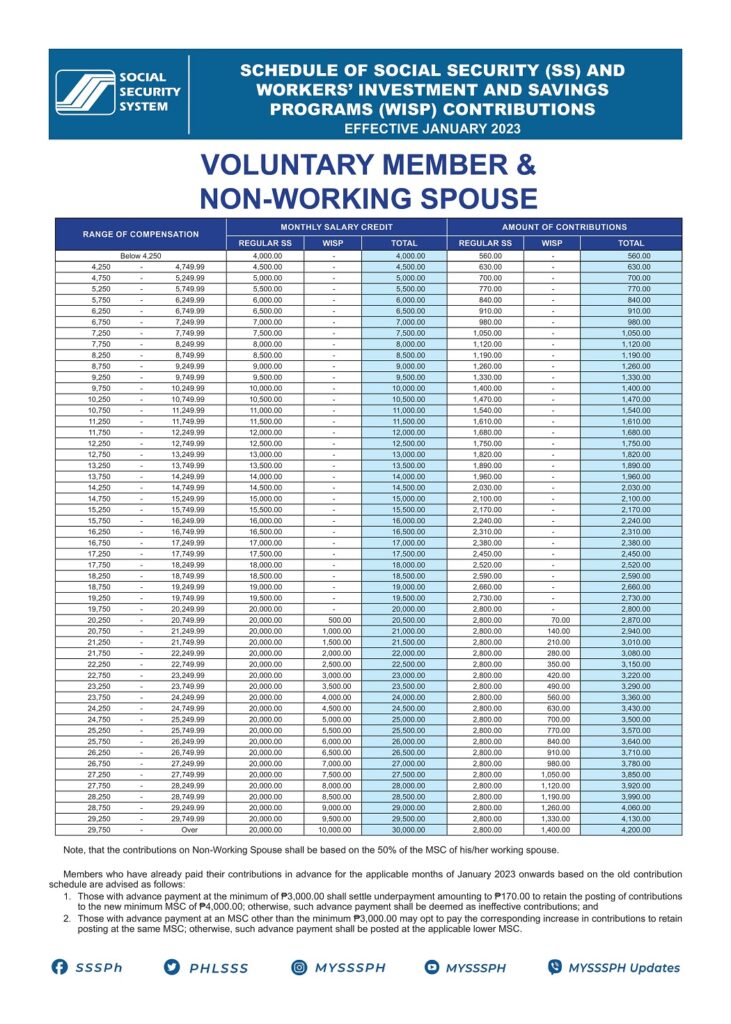

- Self-Employed and Voluntary Members: Self-employed individuals, voluntary members, and non-working spouses are responsible for the entire 14% contribution rate based on their declared earnings .

- Workers’ Investment and Savings Program (WISP): Members with a monthly salary of at least PHP 20,000 are required to contribute to the WISP, a mandatory provident fund scheme aimed at enhancing retirement benefits .

SSS Contribution Table for 2024

The following tables provide detailed information on the SSS contribution rates for different types of members.

Employed Members and Employers

Self-Employed Members

Voluntary Members and Non-Working Spouses

Overseas Filipino Workers (OFWs)

Household Employers and Kasambahay

How to Calculate Your SSS Contribution

Calculating your SSS contribution is straightforward. Follow these steps:

- Determine Your Monthly Salary Credit (MSC): Find your salary bracket in the SSS contribution table to determine your MSC.

- Apply the Contribution Rate: Multiply your MSC by the contribution rate (14%).

- Add the EC Contribution: Add the Employee’s Compensation (EC) contribution to the total.

Example Calculation for an Employed Member

Let’s say you earn a monthly salary of PHP 20,000.

- MSC: PHP 20,000

- Employee Share: 4.5% of PHP 20,000 = PHP 900

- Employer Share: 9.5% of PHP 20,000 = PHP 1,900

- Total Contribution: PHP 900 (employee) + PHP 1,900 (employer) = PHP 2,800

- EC Contribution: PHP 30

- Total Monthly Contribution: PHP 2,800 + PHP 30 = PHP 2,830

Benefits of Contributing to the SSS

Contributing to the SSS provides several benefits, including:

- Retirement Benefits: Members are eligible for a monthly pension upon reaching retirement age, provided they have made at least 120 monthly contributions .

- Sickness Benefits: Members can receive daily cash allowances for up to 120 days if they are unable to work due to illness or injury .

- Maternity Benefits: Female members can receive cash benefits for childbirth or miscarriage .

- Disability Benefits: Members who become permanently disabled can receive monthly or lump-sum cash benefits .

- Death Benefits: Beneficiaries of deceased members can receive monthly pensions or lump-sum cash benefits .

- Unemployment Benefits: Members who are involuntarily separated from employment can receive financial assistance .

Deadlines for SSS Contribution Payment

The deadlines for remitting SSS contributions vary based on the type of member:

- Regular Employers: Last day of the month following the applicable month .

- Household Employers: Last day of the month following the applicable month or calendar quarter .

- Self-Employed, Voluntary, and Non-Working Spouse Members: Last day of the month following the applicable month or calendar quarter .

- OFW Members: January to September – until December 31 of the applicable year; October to December – until January 31 of the following year .

- Farmers and Fishermen: Contributions for any of the last 12 months can be paid in the current month .

Conclusion

The SSS contribution table for 2024 reflects important changes aimed at ensuring the long-term viability and financial health of the Social Security System in the Philippines.

By understanding the updated contribution rates and how to calculate your contributions, you can ensure that you are making the necessary payments to secure your social insurance benefits.

Whether you are an employee, employer, self-employed individual, voluntary member, or OFW, staying informed about your SSS contributions is crucial for your financial security and well-being.

Your comment is awaiting moderation.

Enjoyed every bit of your post.Much thanks again. Great.